Firefly Aerospace has announced the acquisition of SciTec Inc., a move aimed at significantly expanding its footprint in the national security space sector. The deal brings together Firefly’s responsive launch and spacecraft platforms with SciTec’s expertise in electro-optical/infrared (EO/IR) sensing and data exploitation—capabilities increasingly critical for missile warning, missile tracking, and space-based intelligence missions.

Strategic Rationale Behind the Acquisition

The acquisition is part of Firefly’s broader strategy to become a vertically integrated provider of end-to-end space solutions for U.S. defense and intelligence customers. While Firefly has made headlines for its Alpha small launch vehicle and rapidly deployable Blue Ghost lunar lander program, this latest move signals a deeper pivot toward persistent sensing and real-time data delivery in contested domains.

SciTec brings decades of experience in developing mission-critical software and sensor payloads for U.S. national security agencies. Its portfolio includes advanced algorithms for processing EO/IR data from platforms such as Overhead Persistent Infrared (OPIR) satellites—a key capability as the U.S. transitions from legacy SBIRS satellites to proliferated low Earth orbit (LEO) constellations under programs like the Space Development Agency’s (SDA) Tracking Layer.

Tom Markusic, CEO of Firefly Aerospace, stated that the acquisition “positions Firefly as one of the few companies capable of delivering integrated space systems—from launch to on-orbit sensing to actionable data.”

SciTec’s Core Competencies in EO/IR Sensing and Data Exploitation

Founded in 1979 and headquartered in Princeton, New Jersey, SciTec specializes in physics-based modeling of infrared signatures, sensor calibration techniques, signal processing algorithms, and real-time mission software development. The company supports programs across multiple Department of Defense (DoD) agencies including the U.S. Space Force (USSF), Missile Defense Agency (MDA), Air Force Research Laboratory (AFRL), and National Reconnaissance Office (NRO).

SciTec’s capabilities are particularly relevant for:

- Hypersonic missile detection via wide-field-of-view IR sensors

- Space-based early warning systems leveraging OPIR architectures

- Real-time on-board processing using edge computing techniques

- Sensor fusion across multi-domain ISR platforms

The firm has also contributed to key prototypes under SDA’s Tranche 0 Tracking Layer initiative—designed to demonstrate missile tracking from proliferated LEO using multispectral sensors.

Implications for U.S. National Security Space Architecture

This acquisition aligns with broader Pentagon priorities around resilient space architectures capable of operating through kinetic or electronic attack scenarios. As adversaries such as China and Russia field hypersonic glide vehicles (HGVs) designed to evade traditional radar coverage, persistent IR tracking from LEO becomes essential.

By integrating SciTec’s sensor payloads into its own spacecraft bus designs—and potentially launching them via its Alpha rocket—Firefly can now offer turnkey ISR constellations tailored for tactical responsiveness. This could support missions ranging from theater-level missile defense cueing to real-time battlespace awareness over denied areas.

The move also positions Firefly as a potential competitor or subcontractor within major DoD programs such as:

- SDA Tranche 1 & Tranche 2 Tracking Layer deployments

- MDA’s Hypersonic Ballistic Tracking Space Sensor (HBTSS)

- Tactical Intelligence Targeting Access Node (TITAN) integration efforts

Vertical Integration Across Launch, Satellites & Payloads

This deal complements Firefly’s existing portfolio which includes:

- Alpha launch vehicle: A small-lift orbital rocket capable of rapid deployment (<1350 kg to LEO)

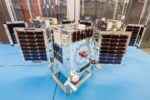

- Elytra spacecraft bus: Modular satellite platform designed for responsive ISR or comms payloads

- Blue Ghost lunar lander: NASA-selected vehicle under CLPS program slated for Moon missions starting late 2024

The addition of SciTec allows Firefly not only to build satellites but also equip them with high-performance payloads optimized for defense applications—reducing dependency on third-party integrators or payload providers.

A Growing Trend Toward MilTech Consolidation in Space Sector

This acquisition reflects a wider trend across the defense space industry where traditional aerospace primes are facing competition from nimble commercial entrants offering vertically integrated solutions at lower cost points. Companies like Anduril Industries have pursued similar strategies by acquiring autonomy firms like Area-I or AI software developers like Adranos AI Labs.

The growing importance of time-dominant ISR—where minutes can determine mission success—is driving demand for companies that can deliver full-stack capabilities spanning hardware design through edge analytics.

Outlook: Next Steps Post-Acquisition

The transaction is expected to close by Q1 2025 pending regulatory approvals. Integration teams have already begun aligning product roadmaps between SciTec’s sensor payloads and Firefly’s Elytra satellite platform.

If successful, this merger could position Firefly among a select group of U.S.-based firms able to field sovereign ISR constellations tailored specifically for DoD requirements—an increasingly important capability amid rising great-power competition in cislunar space and beyond.